Estimating labour costs is a critical part of project planning. In fact, it can be the difference between a successful project and a failed one.

Whether you’re in architecture, creative services, consulting, or any other industry, underestimating project costs can result in cost overruns, eroded profit margins, overworked staff and unhappy clients. Labour is often your biggest cost, so it’s one of the most important parts of any project estimate to get right.

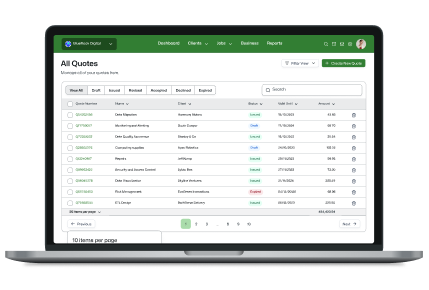

Since you’re dealing with employee time, fluctuating productivity levels and various project uncertainties, it’s difficult to estimate labour costs precisely. However, being armed with precise job quoting software, and spending the time up front to be as accurate as possible, will help you to stay on budget and hit your profitability goals.

We’ve outlined three tips to help you estimate your labour costs so you can increase accuracy with each project you work on.

Top 3 ways to estimate project labour costs with precision

1. Look at historical job data

Reviewing past projects is one of the best ways to estimate future work. It helps you see how well you could deliver work according to previous estimations, evaluate employee productivity and assess overall job performance.

Using a centralised job management system to track time and costs, and generate reports, makes it easier to drill down into the data and get the most valuable insights to inform future estimates. Review data from previous similar jobs to understand the following:

Estimated vs. actual costs

Understand how your actual recorded time and costs compare with your estimated values, and evaluate how any variance might be avoided for your next job.

WIP write-off

Write-off represents the amount of billable time recorded on a job that you weren’t able to charge to your customer (billable WIP minus invoiced amount). Ideally, you’re not writing off any costs, and you’re charging your clients for all of the work you put into the project. Analysing write-offs can give you insight into why you’ve underestimated projects in the past and consider how to adjust estimates for the future.

Ask yourself questions such as:

- Does our team need more training?

- Do we need to price these services differently?

- Do we need to stop offering this service because we can’t do it economically?

Recoverability

Recoverability is the opposite of a write-off – it represents the amount of billable time you invoice to a client. Ideally, recoverability should be at 100% for each project. Recoverability can be an indication of employee performance and their ability to complete work according to projections.

Profit margin

Profit margin is the difference between your invoiced and actual costs (invoiced amount minus actual costs). While it’s certainly important to understand how profitable your jobs are, profit margin isn’t the best indicator of a job being estimated accurately. A job can have a high write-off rate, yet still be profitable. Profitability on jobs can also be subjective based on how businesses represent their labour costs.

2. Ensure your staff base rates are accurate

Staff base rates reflect how much it costs to employ a staff member for one hour of work. When you’re estimating, it’s important that the rate you use to calculate labour reflects the true cost of employing each staff member, not just their hourly wage.

Indirect costs associated with employing staff (also known as labour burden) can have a significant impact on the overall cost to deliver a job and job profitability. To determine the true cost of employing a staff member, add allowances for holiday pay, superannuation, sick leave and other types of overhead to their salary.

There’s no one ‘right’ way to calculate staff base rate – what you choose to include in your employees’ base rate will depend on the type of indirect costs you incur related to your employees (such as benefits, office space and travel) and region-specific costs, such as taxes and contributions.

As a general guide, use the formula below to calculate staff base rate for your employees:

Staff base rate formula

Annual employee labour cost in wages (without taxes or overhead)

Hourly wage x hours worked per year

(excluding vacation, sick days and statutory holidays)

+

Annual overhead per employee

Total overhead + number of employees

+

Annual taxes per employee

÷

Annual hours worked for each employee

Hours worked per week x weeks worked per year

=

The final figure represents an estimation of the true cost of employing a specific staff member per hour of labour.

3. Get the right people involved

When calculating labour for a cost estimate, it’s important that you understand the specific tasks that are required, how much time you need to allocate to each task, and how much it costs your business to deliver each hour of work.

Many different people with varied expertise are typically involved in delivering one project – such as business development or account managers, project managers, specialists who are hands-on in the project, and the director or business owner.

When you’re building out your estimate, include people from all stages of the project lifecycle to make sure you fully understand details, risks and dependencies that could impact labour costs.

Wrapping up

There’s a lot that goes into creating an accurate cost estimate – from defining project scope, to using the right technology, and more. Plus, it’s important to figure out which estimating practices work best for your business.

Take a closer look at WorkflowMax by BlueRock's estimating and quoting feature and see how it can help your business to make the most accurate quotes for your jobs going forward – saving you time and money.